Palo Alto Market Analysis – May 2010 to May 2012

Palo Alto is a strong market which feels the ebbs and flows of the fickle real estate market less than both its more expensive and less expensive counterparts. Palo Alto should be considered a seller’s market with a rapid turnover of its inventory with DOM averaging between 10-20 days for the last four months, and not over 50 days since March 2011. The median price has been on a steady increase for the better part of the last year, and the sales absorption rate has been following the same trend. Historically, Palo Alto has been a very desirable place to live and will continue to be one of the most consistent investments in all of the Bay Area for the foreseeable future. All the market data should continue its upward trend and only time will tell how high it will go.

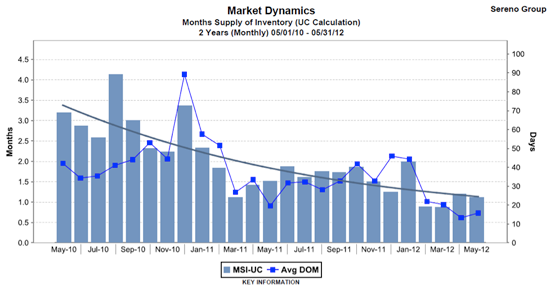

The MSI and DOM for Palo Alto are shown on the chart above. The DOM has seen a mostly downward trend since May 2010 without large cyclical changes. For the most part, the level of inventory has been decreasing since May 2010 with a slight uptick in the last couple of months. Inventory supply is currently sitting at just over one month.

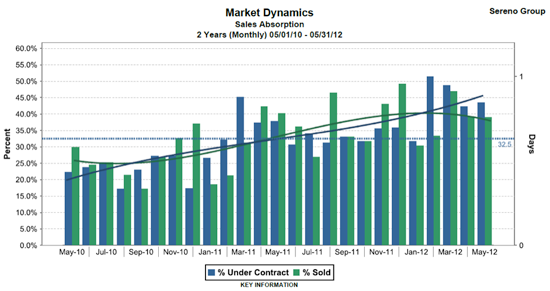

From May 2010 to May 2012, the sales absorption rate has been steadily increasing. In May 2012, the current sales absorption rate was 43.5% of properties under contract and 39.0% of properties sold.

Palo Alto’s median price only dipped slightly in late 2010/early 2011, then saw an early start to its upswing in July 2011 as opposed to the September 2011 upswing start in the Mountain View, Los Altos, and Los Altos Hills. As far as price, Palo Alto’s continuing median price increase is the most consistent of Mountain View, Los Altos, and Los Altos Hills ending in May 2012 at $1,654,500.