July 2020 Silicon Valley real estate market update

Welcome to our newsletter. This month, we take an initial look at the first half of 2020 in the context of the local, state, and national real estate markets. Since March, the pandemic has brought us largely into our homes. Many of us have learned through the last several months that the quality of our dwellings greatly affects the quality of our lives. Our time in our homes will likely continue as Governor Newsom began scaling back California’s reopening on July 13 without a stated end date. During uncertain times like these, we continue to provide you with the most up-to-date market information, so you, our clients, feel supported and informed.

In this month’s newsletter, we cover the following:

Key News and Trends this past July: Across the United States, COVID-19 cases continue to rise as the economy struggles. Local rental markets experience rent drops. Meanwhile, pending home sales set records nationwide.

July Housing Market Updates: Silicon Valley’s single-family home prices increase with all three counties reporting higher prices compared to last year. Sales rebound and months supply of inventory heads back down towards familiar lows.

Key News and Trends in July:

Data released on July 8, 2020 by Johns Hopkins University, showed that California was among 12 states with record-high, seven-day averages for daily new coronavirus cases. California also saw a surge in the number of hospitalizations. Gavin Newsom said at a news conference on July 8th that over the previous two weeks, the state has seen a 44% increase in hospitalizations and a 34% increase in intensive care unit (ICU) admissions.

In our May newsletter, we cited the same sources, which predicted that nationwide hospitalizations would be near zero by July. Now, experts predict that hospitalizations will continue to trend upward as we head later into the year. This will prolong some of the negative economic effects that the pandemic has already induced—nearly one in every six California workers is out of a job, and many others face reduced hours.

The Silicon Valley rental property market is one sector feeling the effects of the prolonged pandemic. As reported by the San Francisco Chronicle, rents for a one-bedroom apartment dropped most in the cities with a high concentration of tech jobs. In Mountain View, home to Google, rents fell 15.9% year over year, while in Apple’s hometown of Cupertino rents dipped 14.3%. In San Bruno, where YouTube has its offices, rents tumbled 14.9%. Compared to homeowners who have access to useful financial support tools, namely refinancing at a lower rate and forbearance, lowering rents is difficult to do because rents can only be renegotiated if the landlord is willing. While local governments can extend the moratorium on rent evictions during the pandemic, the protections do not include rent cancellation; renters will still owe missed rental payments within six months.

In general, renters are the first to experience housing burdens because they have much smaller savings and are more vulnerable to income shocks. As reported by UC Berkeley in April, roughly 50% of likely-impacted renter households were already struggling with rental cost burdens before the COVID-19 crisis took hold. Although the decline in renters will not necessarily impact single-family homes and condos immediately, a persistent exodus and subsequent rent price declines could slowly make its way to homeowners’ equity. One way to value a home is to calculate the net present value of rental income were the owner to rent the property.

Meanwhile, both state and local housing markets remain resilient, partly because of healthy home sales in an undersupplied market, which is a phenomenon also seen nationwide. On June 29th, the National Association of Realtors (NAR) reported that pending home sales mounted a record comeback in May, rising 44% and chronicling the highest month-over-month gain since the index’s inception in 2001.

July Housing Market Updates for Silicon Valley

In the month of June, single-family home prices rose in all three markets. Looking at the last four months, price movements have been relatively stable.

Looking at median price data compared to the previous year, all three markets finished June with higher prices. This was a big jump from May for San Mateo and Santa Cruz, where prices had been lower by 7% and 9%, respectively.

Similar to San Francisco and neighboring counties across the bay to the east, condo prices struggled. June saw condo markets decline nearest the economic centers of San Francisco and Silicon Valley. Those farther away, like Santa Cruz, posted gains in the condo market.

Silicon Valley’s single-family home prices were buoyed by lack of supply compared to demand. As we continue to report, the biggest impact has been on sellers who face logistical challenges in selling their homes, such as the safety of inviting prospective buyers into an occupied home. The majority of sellers are simultaneously buyers themselves, which means they are navigating two transactions. For this reason, sellers have taken a tempered approach to entering the market.

Unfortunately, COVID-19’s rise seems to have amplified buyer and seller tendencies. Weekly new listings for single-family homes are having a tough time rising above pre-pandemic levels. During a typical year, the summer months see many more new listings than winter.

Meanwhile, buyers have been more aggressive. Matt Levin, head Housing and Data journalist for CalMatters, argues that prolonged record-low inventory coincided with the huge millennial generation reaching home buying age. Much of these hopeful and credit-worthy home buyers built up the savings to meet tight lending standards. These home buyers still want access to homeownership.

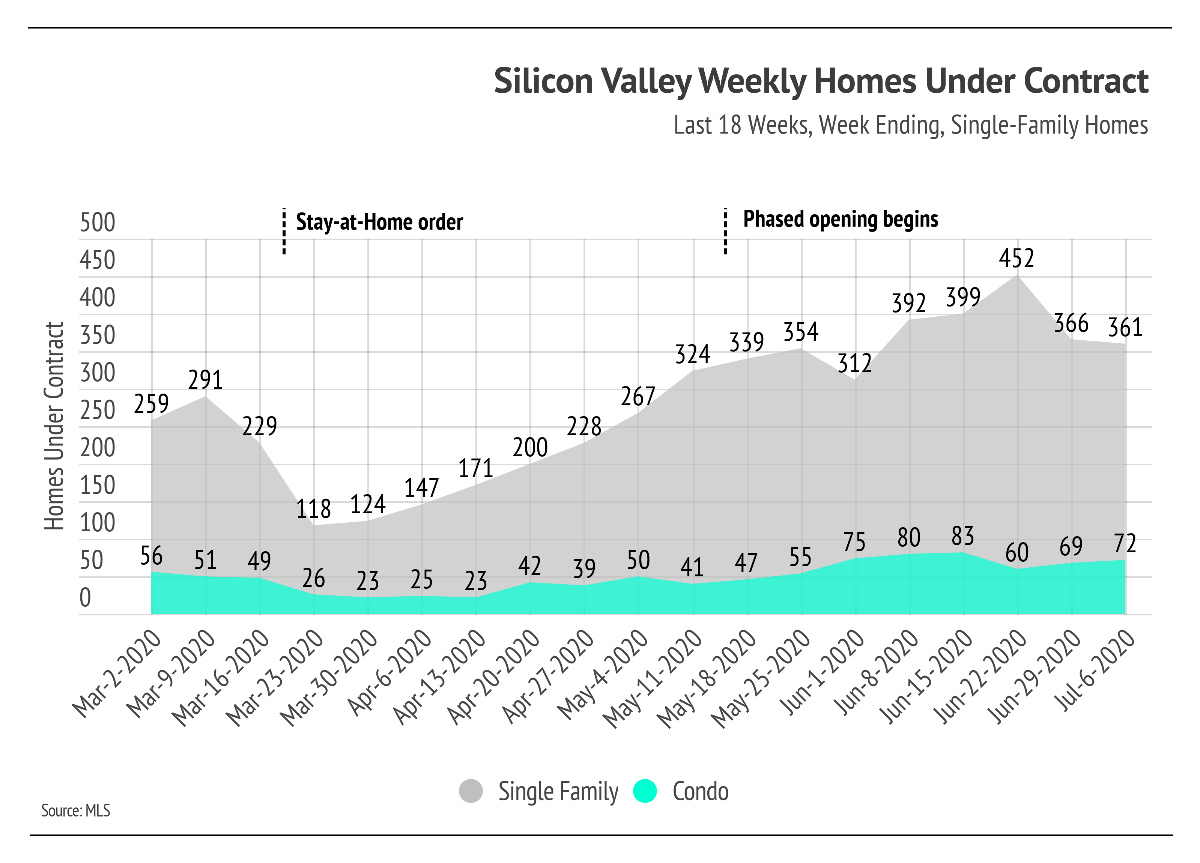

To address Levin’s point, Silicon Valley’s homes under contract have far surpassed pre-pandemic levels, albeit the rise in homes under contract tapered in June as news of the prolonged pandemic set in.

We can also take a look at home sales—the result of homes under contract that close within 30 days—on a monthly basis. Compared to May, home sales in June rebounded in all Silicon Valley markets. Santa Cruz similarly saw a positive trajectory when compared to last year and sales in Santa Clara were only down by 1%.

Together, fewer listings and higher sales moved inventory levels back down for single-family homes. Measured weekly, we can see the levels for single-family homes trended lower every week in June. Conversely, we also see a steady rise for condos.

Months of Supply Inventory (MSI), the measure of how many months it would take for all the current homes for sale on the market to sell at the current rate of sales, has an average of three months in California. A number lower than three means that buyers are dominating the market and there are relatively few sellers; a higher number means there are more sellers than buyers. In June, the MSI for single-family homes fell well below the three-month average and continues to favor the sellers across all three markets. For buyers in Silicon Valley, these are familiar lows.

Higher prices indicate that there are not many bargains on the market. However, June’s sale-to-list ratios—which compare the prices buyers pay to the original list prices of homes—suggests that buyers are also not paying large premiums due to bidding wars. In Silicon Valley, buyers negotiated prices in line with the original list price, or at a slight discount, to put a property under contract.

In summary, as we discussed in previous newsletters, the fundamentals of the housing market were strong before the global economy stalled, and they have continued to show stability. The prolonged pandemic will continue to cause fluctuations in the market, some of which can be measured weekly. It is now more important than ever to have access to the advice of real estate professionals.

Looking ahead to August, we anticipate the undersupply in housing to continue. The COVID-19 spike in California and across the country has created economic and personal unease. Sellers tend to be more timid during this time while buyers are more aggressive, feeding into the undersupply and lifting home prices. As more supply becomes available, there could be a correction in the market, but we do not believe that is likely through the summer months.

As always, we remain committed to helping our clients achieve their current and future real estate goals. Our team of experienced professionals are happy to discuss the information we have shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.